SCTI reveals most expensive claims of 2017

Kiwi travellers don’t need to be heading on an intrepid journey to land themselves in a foreign hospital with a massive bill – it could happen from something as simple as falling down stairs.

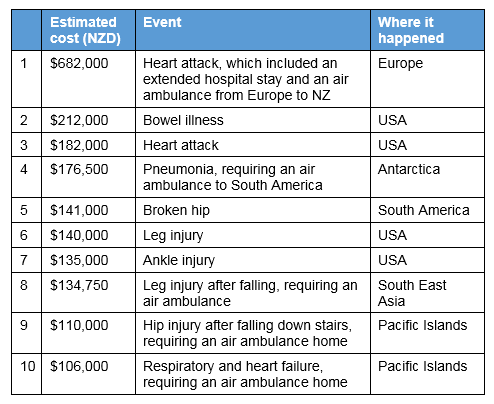

One Southern Cross Travel Insurance (SCTI) customer last year racked up a $110,000 medical bill in the Pacific Islands after tripping and falling down a flight of steps, injuring their hip. It was one of the top 10 medical claims in 2017 paid by SCTI, New Zealand’s largest travel insurer.

The insurer’s largest claim for the year was for a customer who required a lengthy hospital stay and an air ambulance flight home after suffering a heart attack while travelling in Europe. The cost of their treatment totalled $682,000, one of the highest claims SCTI has paid in its 36-year history.

Another claim shows the breadth of destinations SCTI covers: one claim, totalling $176,500, was for a customer who required an air ambulance flight from Antarctica to South America after suffering from pneumonia.

Nearly half of the top 10 claims in 2017 happened in the United States, which is renowned for having some of the highest medical care costs in the world.

Southern Cross Travel Insurance Chief Executive Chris White says some hospitals in the US may request a large deposit before they will even start providing treatment.

“This is one of the key areas where having travel insurance is important. Our emergency assistance team, who are available to help 24 hours a day, seven days a week, may be able to negotiate directly with the hospital on your behalf and eliminate the need for you to pay a large deposit. We can also keep immediate family advised of the situation and coordinate medical evacuations,” he says.

“New Zealand’s public healthcare system means we generally don’t have to worry about the financial cost when we get injured or sick, but this isn’t the case overseas. It doesn’t take long for the bills to reach eye-watering amounts — it can cost up to $US50,000 a day for intensive care treatment at a US hospital.”

White says the list of the most expensive claims shows the importance of buying travel insurance before heading overseas, even if it’s for a seemingly safe holiday or destination.

“The average price of a Southern Cross Travel Insurance policy can be as little as the cost of a coffee a day so it’s an affordable one-off payment that could end up saving you tens of thousands of dollars.”